Sinclair Schuller May 13, 2020

At their core, digital platforms are decentralized value creation and distribution engines. Through their inherent extensibility, platforms allow for the formation of an ecosystem of customers and partners around the platform. Each ecosystem member extends the platform with new value that then gets published to the rest of the ecosystem. This decentralized value-creation model allows for rapid innovation. “Remote enabled,” which was once optional, has become table stakes in a post-COVID world – a necessary innovation. Going forward, it’s hard to imagine value creation occurring in any way other than decentralized. At Nuvalence, we’ve spent a significant amount of time formalizing our thoughts on the topic (executive summary slides as Google Slides or PDF, or for an extensive read, our whitepaper).

Our modern pandemic may have created a “once in a lifetime” opportunity for market leaders if they’re willing to invest in accelerating their digital platform strategies. It’s best to understand the opportunity through the lens of one of the most important texts in modern business and technology strategy: “The Innovator’s Dilemma”.

When Clayton Christensen released “The Innovator’s Dilemma” in 1997, he very clearly articulated why successful, incumbent firms often fail when challenged with new, disruptive technologies. Intuition would tell you that being a market leader with lots of revenue and many resources is tremendously advantageous, and it often is. But Christensen determined that an incumbent’s market leadership position also implied certain structural disadvantages:

-

Emerging technologies don’t define large markets – at least at first. These small markets are uninteresting to incumbents because they don’t have any material near-term impact, making small markets “not worth” pursuing. At a feature or technology level, this also means that disruptive technologies are often perceived as “unneeded” based on things like customer research. The woefully misled statement “no customers are asking for this” comes to mind.

-

Incumbents often “follow the money” and invest energy and resources in current, tactical customer needs often led by “customers are asking for this” type of statements. While this seems to be a corollary to (1), it’s more than that. It’s not only that incumbents don’t invest in disruptive capabilities, but they actively pour resources into something that will likely be disrupted.

-

Incumbents will often drive efforts using existing processes and capabilities, which themselves are optimized for current products, and not for new products or new ways of thinking. Additionally, existing processes may bias toward existing solutions.

-

Incumbents prioritize predictability. Disruptive technologies are not predictable in either how or what features will be successful, or which market(s) will be disrupted.

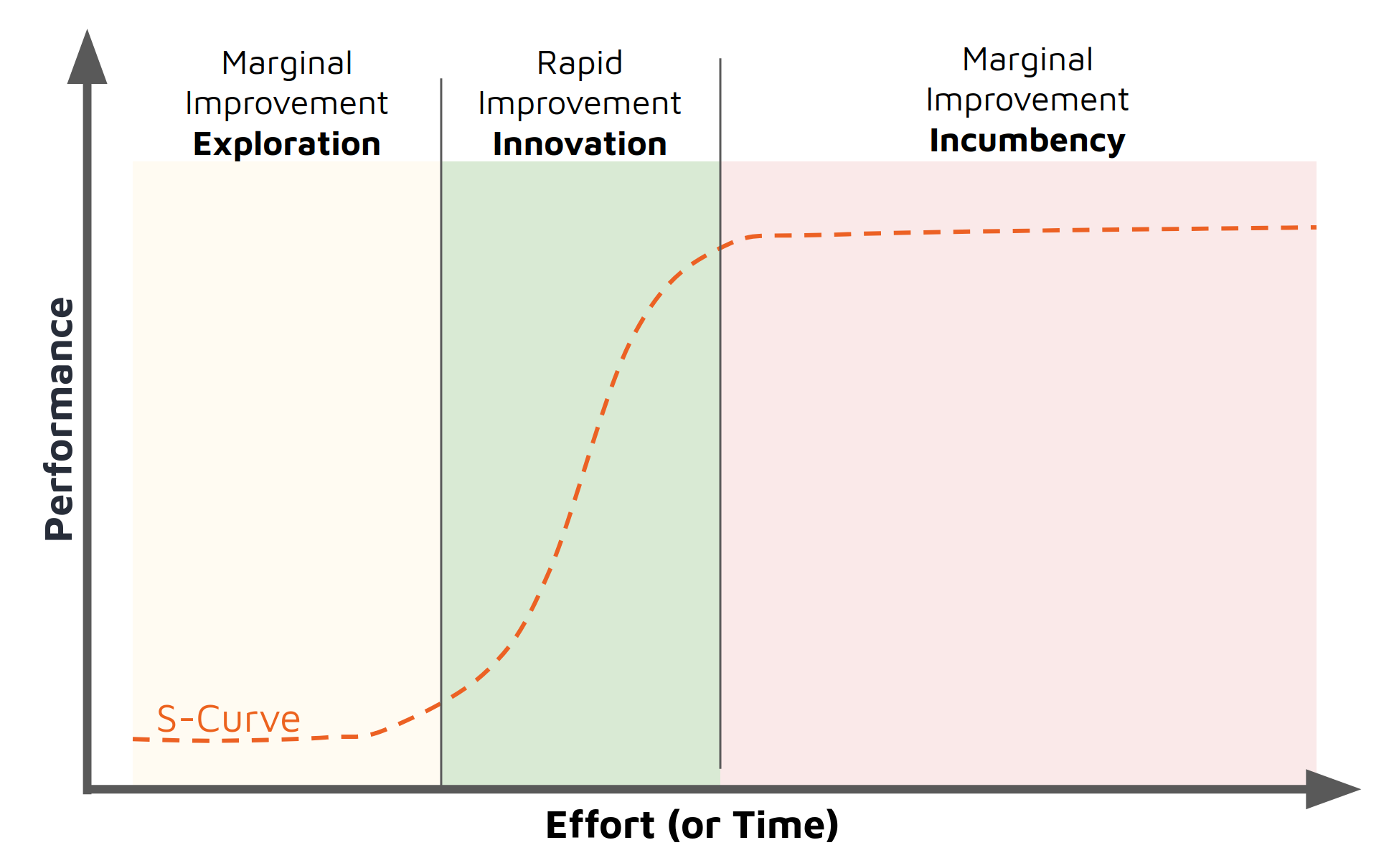

Christen used the “S-Curve” to describe the shape of market size/rate of investment in innovation and how it drives focus; the steep part of the ‘S’ describes rapid innovation and market growth, warranting investment. Over time, however, the market size for current solutions begins to plateau – a “flattening of the curve” of sorts. As we all know by now, in epidemiology, “flattening the curve” is the strategy that leads to safety. Although a plateau in an S-Curve isn’t quite the same type of flattening, it’s still illustratively meaningful. S-Curve “flattening” is where an incumbent finds themselves vulnerable. The flatness describes a business context where incumbents are discouraged from investing in innovation because it’s misaligned with tactical customer need, market size, and profitability.

While potentially unintuitive and obfuscated by the cloud of recent negative news, a flattening of the COVID-19 curve might serve as a catalyst to unflatten the incumbent S-Curve, introducing new growth potential to incumbents that try and take an offensive position instead of a defensive one. If true, this would be a once-in-a-lifetime opportunity for incumbents combating their “Innovator’s Dilemma.” But how? The disadvantages described by Christensen are underpinned by a set of assumptions of how a market evolves, and how an incumbent should amplify focus on small but disruptive technologies. These assumptions usually hold incumbents hostage, requiring a carefully crafted execution model to navigate the S-Curve. COVID-19 has had an interesting effect in turning those assumptions upside down abruptly and with an acute impact on addressable market share:

-

Customers are demanding “remote-enabled” technologies. What might have been a niche feature not warranting meaningful investment became a high-demand differentiator overnight

-

Previous structural advantages that drove regular investment by incumbents may now be harmful in the context of a post-COVID world, opening the door to a reduction of investment in the old and redirected to the new

-

Existing processes used by incumbents need to be re-engineered. This creates a window of opportunity to not only re-engineer those processes to deal with the post-COVID context but to also take advantage of disruptive technologies

COVID-19 flattening may have neutralized some of the disadvantages Christensen outlined, giving the world’s biggest brands a unique moment in time to re-invent their goods and services to be more digital and more aligned with newly formed customer demand. Normally, disruption happens slowly at first and then hits all of a sudden. This is, in part, why large organizations are slow to react and pay attention early on. COVID-19 hit every organization suddenly and with force. This draws a clear line between pre/post-COVID worlds for incumbents, producing a rare moment of clarity. We also find ourselves in a rare situation where Wall Street is generally ignoring short-term results and earnings, opening up a window to focus on strategic outcomes under the cover of acceptable, missed earnings and revenues targets. In a way, it’s as if companies get to go “private” for a few quarters.

We’ve been advising customers on the topic of what post-COVID goods and services might look like, and how a platform-centric strategy is critical to success. Taking advantage of this opportunity means recognizing that your goods and services need to change to be more remote-enabled and more digital. Because of the macro-circumstance, however, it also means that the goods and services of all your partners need to change in the same manner. Building a digital platform is the only way to ensure that your new, disruptive strategy is capable of being extended to incorporate ecosystem value, and to equip customers to truly benefit from this “remote first” new world.

How much thought have you and your team invested in determining how your offerings need to change to thrive in this new reality? Have you given consideration to how your ecosystem of partners will change and whether that should accelerate your investment in creating a digital platform?