Financial

ADP Developed an Innovative and Secure Digital Wallet in a Few Months Using AWS Services

Impact Summary

Thanks to the work from Nuvalence in collaboration with AWS and ADP, Wisely card members now have a well-rounded financial wellness platform to support their employee needs.

Key features such as Earned Wage Access give eligible members access to their earned wages before payday, creating a viable alternative for customers when they need access to funds the most, and eliminating the need to take out high interest-rate loans.

High-Level Benefits:

- Increased development speed, creating a digital wallet in just a few months.

- Provides customers unprecedented fiscal flexibility with Earned Wage Access feature.

- Fortifies security using tokens and oversight.

- Supported processing of nearly $1 billion of transactions in customer accounts in 7 months.

The Opportunity

ADP, a global leader in human capital management solutions, wanted to provide workers across North America unprecedented flexibility with a modern digital wallet.

Founded in 1949, ADP serves one million customers in 140 countries with its human capital management software. As the source of pay for one in six Americans, ADP saw an opportunity to help enhance the employee experience through financial wellness offerings. The company wanted to move quickly to provide a socially responsible option for its existing customers and lead the way with a modern industry solution. ADP’s digital wallet includes on-demand access to eligible workers’ earned wages before payday, enables online shopping, and many other cutting-edge features.

ADP’s vision was to use its robust workforce data and many years of experience to create a product that adapted to the modern way that people manage their money. To make that vision a reality, ADP needed to build a solution that supported high security and privacy standards, facilitated going to market quickly, and offered technology for innovation. ADP worked alongside Amazon Web Services (AWS) and Nuvalence, an AWS Partner that ADP has worked with on other business initiatives since 2019, to use modern, cloud-native development practices to build the solution for its digital wallet.

The primary goals of the engagement were:

- Develop a highly resilient and scalable financial wellness platform with capabilities like digital wallet services, providing U.S. customers with unprecedented flexibility via Earned Wage Access features.

- Fortify the financial wellness platform security using tokens and oversight.

- Provide workers with access to the platform via an intuitive mobile user experience.

The Approach

Aligning on Infrastructure and Architecture

One important goal was to align on the cloud infrastructure and the set of technology choices that would be applied in building the platform. ADP has been using AWS services since 2015, making it the clear cloud provider of choice due to its ability to support the architectural requirements and the alignment with the current developer ecosystem at ADP.

“The AWS team has been with us through thick and thin and is always responsive. By using AWS, we have incorporated best practices while building resilient systems that resilient systems that can handle our global scale,” says Lohit Sarma, Senior Vice President of Product Development at ADP. “Nuvalence has been a strategic partner of ours, delivering high-quality work. Its expertise in building large-scale digital solutions was an ideal fit for our needs, and we brought the firm in to provide high quality execution.”

“Nuvalence has been a strategic partner of ours, delivering high-quality work. Its expertise in building large-scale digital solutions was an ideal fit for our needs, and we brought the firm in to provide high quality execution.”

Lohit Sarma, Senior Vice President of Product Development at ADP

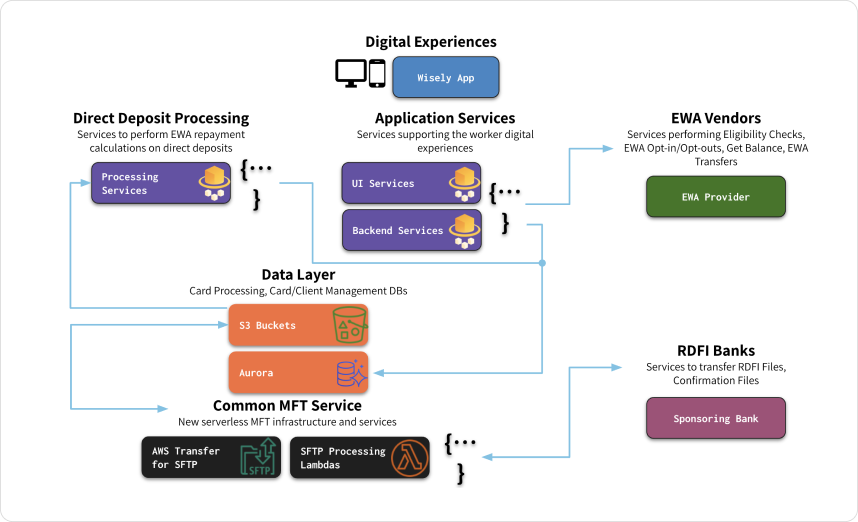

Teams from ADP, Nuvalence, and AWS worked together to create an architecture diagram detailing the platform components and customer journeys, and used those as the basis to start mapping the execution necessary to deliver the digital wallet capabilities.

The team leveraged AWS Lambda as the underpinning compute service for the platform, using its serverless event-driven compute service to run code without thinking about servers or clusters. The digital wallet uses AWS Lambda to create a variety of different functions, minimizing the compute footprint of the service. “The team used AWS Lambda to provide an efficient and scalable approach to handling authentication, authorization, and other key functions for the wallet,” says Abe Sultan, partner at Nuvalence and executive sponsor of the Nuvalence team working with ADP. Using serverless technology, ADP could both go to market quickly and leave room to scale for future growth as the needs of the platform evolve.

ADP needed flexibility and extensibility to ensure a dynamic solution for a fast-moving market with many changing variables. ADP provides education for companies as they roll out the Earned Wage Access feature. With these details, eligible members can make informed decisions while getting valuable access to earnings when they need it. “ADP takes great pride in being a company with high morals that is always there for its clients and their people,” says Lohit. “Using AWS services, we can give people tools to manage their finances and give them access to funds when they potentially need them the most.”

Aligning on Security

Because ADP manages employee and financial services, the company needed the solution to meet rigorous compliance-quality standards, including the Payment Card Industry Data Security Standard. The team bolstered the security of the digital wallet using services like Amazon Simple Storage Service (Amazon S3), an object storage service built to retrieve virtually any amount of data from anywhere. Using Amazon S3, ADP can securely store flat text files involved in money movement. The platform also uses tokens for the card numbers to keep transactions secure. In fact, because the payment credentials are loaded securely into the digital wallet, customers could use the digital card to enable purchases and make payments immediately without waiting for a physical card to arrive in the mail.

“Data security and privacy are critical to everything we develop,” says Lohit. “Using AWS services, we could uphold our company’s existing standards while innovating on the implementation.”

Delivering the Platform

The digital wallet development started in early 2022. Once the team aligned on the architecture and security requirements, AWS made service recommendations based on the use case and existing architecture. Nuvalence paired with ADP engineers to design and build the solution, maximizing the effectiveness of features based on AWS services and providing the glue that connected ADP’s infrastructure and existing set of services. Although similar projects often take several years to complete, ADP released the first version of its digital wallet in just a few months.

Key Results

The engineering teams used modern tools and AWS’s cloud infrastructure to develop the digital wallet platform in a matter of months, instead of the years it typically takes for projects of similar size and complexity. ADP has seen a positive response in usage of its digital wallet in the U.S., processing nearly $1 billion of transactions in customer savings envelopes in the 7 months since launching the product.

As of 2022, ADP supports approximately 1.7 million Wisely card members in the United States and plans to keep investing in its digital wallet while rolling out additional features using AWS services. With its digital wallet, ADP accomplished its mission of making financial wellness tools more accessible to U.S. workers. The digital wallet is a safe and simple option through which employees without a traditional bank account can access their pay, giving them freedom in spending their wages. The Earned Wage Access feature gives eligible members access to their earned wages before payday, creating a viable alternative for customers when they need access to funds the most and eliminating the need to take out high interest-rate loans.

“ADP pays one in six workers in the U.S., moves close to $100 billion in payroll per day in the United States,” says Lohit. “We have to be working 24/7 with high quality, resiliency, and reliability. We brought AWS and Nuvalence together because of these requirements.”

Download a PDF version of this case study.